Tailored liability cover for the directors and officers of healthcare providers.

Directors and officers of healthcare providers have tremendous responsibilities to their patients, employees, creditors, bondholders, vendors and communities. With these responsibilities comes the pressure to deliver the highest quality care while also making difficult decisions to ensure the long-term well-being of their facilities. These decisions could not only jeopardize the continuance of their facilities, but can also put their own personal assets at risk. We offer comprehensive liability coverage that includes:

Up to $10M limit.

The healthcare environment is rapidly changing and presenting new and unique exposures on a daily basis. Beazley Remedy is the newest offering that gives directors and officers the coverage they require to operate their facilities while also giving them peace of mind knowing that they are adequately covered and protected in this ever changing healthcare landscape. Beazley Remedy offers coverage against a wide range of potential healthcare specific claims while also offering a wide array of coverage enhancements.

Healthcare directors and officers

USA

BEING BOLD

Freedom lies in being bold. We dare to be different and seek bold possibilities to create more innovative, fair and satisfying outcomes for our clients, brokers and employees. From insuring the highest building in the world, to the first commercial lunar vehicle to operate on the moon - we boldly go where others won’t.

STRIVING FOR BETTER

Good is a start, but we go all-out for better. A driven community of individuals relentlessly push the needle and creating value. From launching the market’s first dedicated ESG syndicate to the establishment of our business unit focusing on designing digital insurance solutions, we pride ourselves on always going above and beyond. Simply put, at Beazley we go to 11.

DOING THE RIGHT THING

Acting with integrity in a straightforward, decent way is instinctive. Open and honest with others, we show respect and empathy however challenging the situation – demonstrated by our multi-award winning claims team. Doing the right thing makes for a fair-minded, rewarding environment and makes work and life better for all.

Loss scenarios:

A New England hospital sent a pregnant patient to another hospital’s emergency room without having her first examined by a physician. Department of Health officials determined that this was a violation of the Emergency Medical Treatment and Labor Act (EMTALA), as unstable patients are required to be seen by a physician prior to being transferred to other facilities. Defense costs, fines and penalties exceeded $250,000.

A small hospital saw revenues drop due to new competing facilities. It’s primary creditor withdrew over $1 million from the hospital’s operating account leaving the hospital with no way to cover expenses and forcing them to declare Chapter 11 bankruptcy.

Boston, MA, USA

+1 (617) 239 2626

Email Jack

New York, NY, USA

+1 (212) 801 7217

Email Randi

Chicago, IL, USA

+1 (312) 476 6273

Email Brian

Boston, MA, USA

+1 (617) 239 2601

Email Candace

Chicago, IL, USA

+1 (312) 476 6271

Email Scott

Atlanta, GA, USA

+1 (213) 228 7750

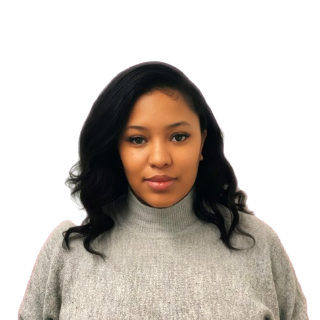

Email Destiny

Chicago, IL, USA

+1 (312) 476 6218

Email RhaniNew York, NY, USA

+1 (212) 801 7159

Email Keri

New York, NY, USA

+1 (212) 801 7110

Email Adam

Chicago, IL, USA

+1 (312) 476 6215

Email Heather

Chicago, IL, USA

+1 (872) 910 3923

Email Amy

Philadelphia, PA, USA

+1 (215) 252 9122

Email Maggie

Chicago, IL, USA

+1 (815) 543 6552

Email Hannah

New York, NY, USA

+1 (212) 801 7119

Email SaraRetaining and improving business resilience to risk is an ongoing priority for healthcare executives. One of the best ways our clients have found to achieve this objective is to focus on hiring and retention policies, with an eye toward boosting diversity and inclusion in the workplace. There are several factors at play here – all inextricably tied to the notion of engagement.

In recent years, the telehealth space has grown significantly, including countless new entrants into the market. These businesses can run the gamut in size. As a virtual care insurer, we see insured go from the pre-revenue phase, through IPO, and eventually to billion-dollar revenues.