Press Releases

Global executives regard employee risk as their biggest threat, new Beazley report reveals

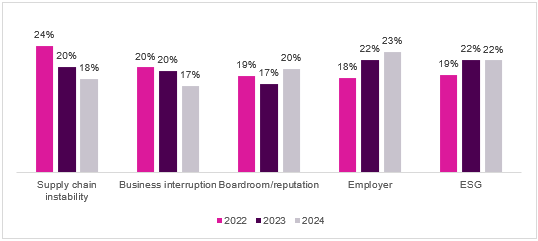

- As the risk environment for employers gets more complex, 23% of global¹ executives cite employer risk as the biggest threat they face, up from 22% in 2023 and higher than any other business risk this year.

- 22% are concerned about ESG regulation and the failure to comply with new legislation, regulation, or reporting requirements. 67% believe that ESG regulation is too complex for their business to deal with, and 70% want more guidance from regulators on ESG regulations.

- 42% also believe they are currently operating in a high-risk environment, compared to just 31% in 2023².

Beazley, the leading specialist insurer, has today published the first insights from its latest Risk & Resilience report: Spotlight on Boardroom Risk 2024.

The report explores the risk concerns of 3,500 global business leaders in today’s era of accelerating risk, where a single misstep can have significant financial, legal and reputational consequences for a firm and its directors – no matter what size or sector it operates in.

Employer risk

In an age of hybrid working, shifting workplace cultures, and a growing focus on misconduct, nearly a quarter (23%) of global executives believe that employer risk is the biggest threat they face this year, up from 18% in 2022³. But, nearly a quarter (24%) feel unprepared⁴ to deal with this risk.

Ambition to increase diversity and inclusion in global firms is highlighted by the report, with 26% of the executives surveyed saying that they plan to review hiring and retention policies to boost diversity and inclusion in the workplace.

Reputation risk

Concern among executives around reputation risk is also growing. In an increasingly interconnected world, businesses face scrutiny from a host of stakeholders, including shareholders, regulators, the media and the general public. Executives are under the microscope like never before. A fifth (20%) of global executives cited reputational damage, the risk of directors damaging brand value and customer trust, as their top business risk, up from 17% in 2023. This rises to 25% among executives in the financial and professional services industry.

Percentage of global business executives ranking Business Risks as their top risk over time⁵

Percentage of global business executives ranking Business Risks as their top risk over time⁵

ESG risk

The raft of ESG regulation across the globe is impacting businesses and their ability to operate in numerous jurisdictions. Our data shows that 67% of global executives believe that ESG regulation is too complex, while 70% want more guidance from regulators.

With competing regulations in different jurisdictions, executives are left to decide which rules to comply with and how much risk they are willing to carry. Anti-trust rules around ESG in a number of US states creates new challenges from a directors’ and officers’ (D&O) liability perspective. And, as a result, some firms and investment funds are rolling back on public commitments around ESG.

Bethany Greenwood, Global Head of Specialty Risks, Beazley said:

“While macroeconomic conditions appear to be stabilising, D&O risks are still front of mind for global business leaders. In the event of a company filing for bankruptcy, D&O litigation can quickly follow for executives. Amid persistent inflation and the ongoing threat of recession, this has been a key threat in recent years.

At the same time, businesses and their executives are feeling the heat, with D&O liability extending beyond the realms of financial performance, with litigation now being brought against executives following cyberattacks, supply chain disruption and employment-related issues. Failure to comply with ESG regulation has proven another key flashpoint for D&O risk. Our latest report highlights how the threat landscape has fragmented and become increasingly multifaceted with executives left scrambling to protect themselves. Understanding the risks and enhancing resilience has never been more important.”

¹See methodology for details

²See methodology for details

³See methodology for more information

⁴‘Not very well prepared’ and ‘not at all’ prepared answers combined

⁵See methodology notes