Article

Geopolitical risk: are business leaders complacent about the threat?

Beazley’s Risk & Resilience research reveals that businesses face a perfect storm of a high risk / low resilience world - with leaders predicting risk will peak in summer 2022

Beazley undertook its annual survey of business leaders’ attitudes to risk and resilience in January, before the Russian invasion of Ukraine. At that point, only 25% of those surveyed felt they were operating in a high-risk environment. However, asked to project forward six months almost half (43%) of UK leaders and over a third (38%) of US leaders anticipate that they will be operating in a high-risk world by the middle of the year.

Geopolitical risk is rapidly rising

Geopolitical risk has moved rapidly up the risk agenda since the previous survey, with war risk ranking top for over a fifth (22%) of UK and US leaders by summer 2022.

Economic uncertainty, which dominated business thinking even before the invasion, has risen 6 percentage points on the same time last year, with 27% ranking this their top risk in January 2022, rising to 28% in 6 months’ time.

When asked about inflation, well over half of respondents (55%) globally say they are very or moderately concerned about their ability to mitigate it during 2022. In the US, however, that proportion rises to 65%, the highest of any country surveyed.

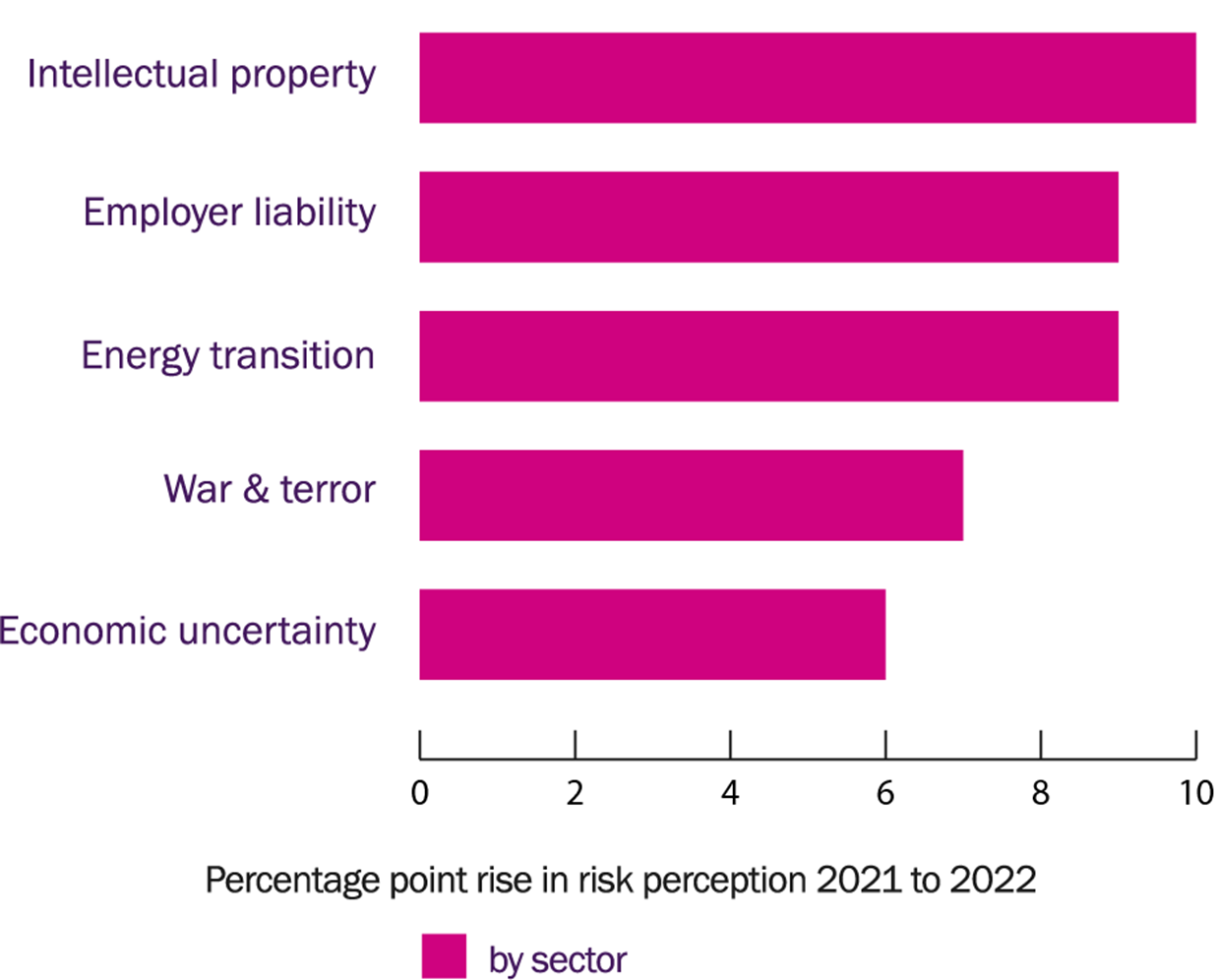

Other fast-rising risks in January 2022 include employer risk, intellectual property (IP) risk and energy transition risk, which have all broadly doubled on 2021 levels.

Resilience crumbles

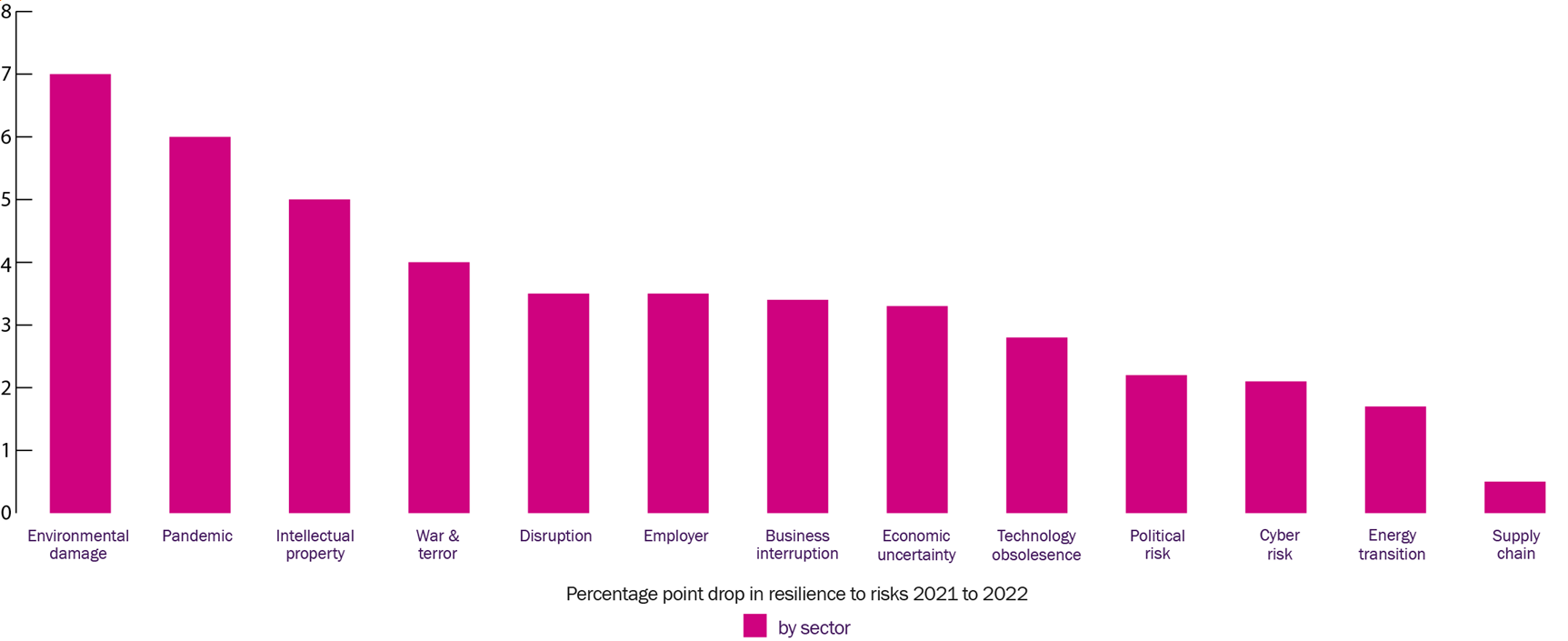

Concerningly, as risk perceptions overall have risen, so perceived resilience has fallen back dramatically. Only 27% report feeling highly resilient about managing risk in January 2022, compared to over a third of US and UK business leaders (35%) believing they had the required resilience when we asked this question last year.

As last year, UK business leaders are notably less confident than their US peers.

Biggest resilience drops

Emerging threats from the changing world of work post-pandemic are showing up in the fall in perceived employer resilience and concerns over disruption due to factors such as changing customer behaviour or market shifts.

Adrian Cox, CEO, Beazley says:

“Business leaders continue to face perhaps the stiffest test in a generation as the world reels from the economic whirlwind unleashed by COVID-19 to the unfolding horror and ensuing geopolitical dislocation caused by the Russian invasion of Ukraine. Business resilience is under real threat as companies adjust to a new world order in which everything, from trading relationships, through commodity prices to supply chains, needs to be re-evaluated from the ground up. As insurers we must step up and help businesses work through this perfect storm of a high risk / low resilience world.”

High risk-low resilience

The threats of greatest concern to businesses appear in the top left high risk / low resilience quadrant of the Risk & Resilience matrix. Economic uncertainty, and supply chain risk dominate in this quadrant along with pandemic risk. New entrants to this quadrant this year include environmental damage and inflation risk. When the question was asked in January, war and terror were an area where business believed their resilience was low but even at that point they were only perceived as low risk. If asked the same question today we can speculate that this class of risk may have moved up into the high risk / low resilience quadrant.

High risk / high-resilience

Cyber risk stands clear of every other as a top risk to business but one to which businesses feel particularly resilient about. This positive sense of resilience may reflect the fact that almost half of respondents say their top priorities are investment in improved cyber security (43%) and risk management and loss prevention initiatives (42%).

Risk & Resilience research 2022

These are some of the key findings of the Beazley Risk & Resilience Research 2022, in which we track the significance of four key risk groupings to business leaders globally: geopolitical risk, digital risk, business risk and environmental risk.

Throughout 2022 Beazley will be producing a suite of insightful reports and analysis based on our research with business leaders around the issues of risk and resilience, to register your interest in receiving these reports please get in touch.

About our Risk & Resilience research:

During January 2022 Beazley commissioned research company Opinion Matters to survey the opinions of over 1,000 business leaders and insurance buyers of businesses based in the UK and US with international operations. With a minimum of 40 respondents per country per industry sector, respondents represented businesses operating in:

- Healthcare & life sciences

- Financial institutions & professional services

- Manufacturing

- Energy and utilities (including mining)

- Retail, wholesale, food & beverage

- Public sector & education

- Real estate and construction

- Tech, media & telecoms

- Hospitality, entertainment & leisure

- Marine & warehousing

Of the firms surveyed in both the US and the UK there was an equal split of respondents across company sizes of: $250,000 - $1 million, $1,000,001 - $10 million, $10,000,001 - $100million, $100,000,001 - $1 billion, more than $1 billion.

Note to editors:

Beazley plc (BEZ.L) is the parent company of specialist insurance businesses with operations in Europe, United States, Canada, Latin America and Asia. Beazley manages seven Lloyd’s syndicates and, in 2021, underwrote gross premiums worldwide of $4,618.9m. All Lloyd’s syndicates are rated A by A.M. Best

Beazley’s underwriters in the United States focus on writing a range of specialist insurance products. In the admitted market, coverage is provided by Beazley Insurance Company, Inc., an A.M. Best A rated carrier licensed in all 50 states. In the surplus lines market, coverage is provided by the Beazley syndicates at Lloyd’s.

Beazley’s European insurance company, Beazley Insurance dac, is regulated by the Central Bank of Ireland and is A rated by A.M. Best and A+ by Fitch.

Beazley is a market leader in many of its chosen lines, which include professional indemnity, cyber, property, marine, reinsurance, accident and life, and political risks and contingency business.